From June 11 – 14, The Beacon hosted its first focus week: Get Connected. Besides hosting a workshop on Geofencing Smart Contracts, we attended sessions on AI, Smart Industry, Big Data and IoT. We took the time to reflect on the most important lessons we learned.

On security

1. Your smart home security system makes you vulnerable

To give a tangible example of why data security matters, researchers at NVISO tested consumer-grade smart alarm systems for security flaws. They found numerous vulnerabilities, ranging from exposed network passwords to remotely taking control and disabling someone else’s security system.

Burglars are aware of these weaknesses, too. Professional gangs use powerful, portable jammers to block a wide range of frequencies, including WiFi and even cell networks. These devices can easily be purchased online.

2. Manufacturers don’t want to be bothered with data security

The NVISO researchers contacted the companies selling the vulnerable alarm systems. Unfortunately, none of the manufacturers fixed the vulnerabilities that were found – regardless of price range. Those who did care to reply, said they were bringing out a new model, so they would not invest in patching the “older” models.

3. Cybersecurity is more accessible than you think

Today, countless applications contain very basic security vulnerabilities. Organisations such as OWASP (Open Web Application Security Project) provide helpful guides and checklists to help you secure your software. The CIS (Center For Internet Security) guidelines are another useful resource for those aiming to build secure, modern applications.

On big data in Belgium

4. At the Sinksenfoor or Tomorrowland? Your mobile device gives critical information for security officials and marketers alike

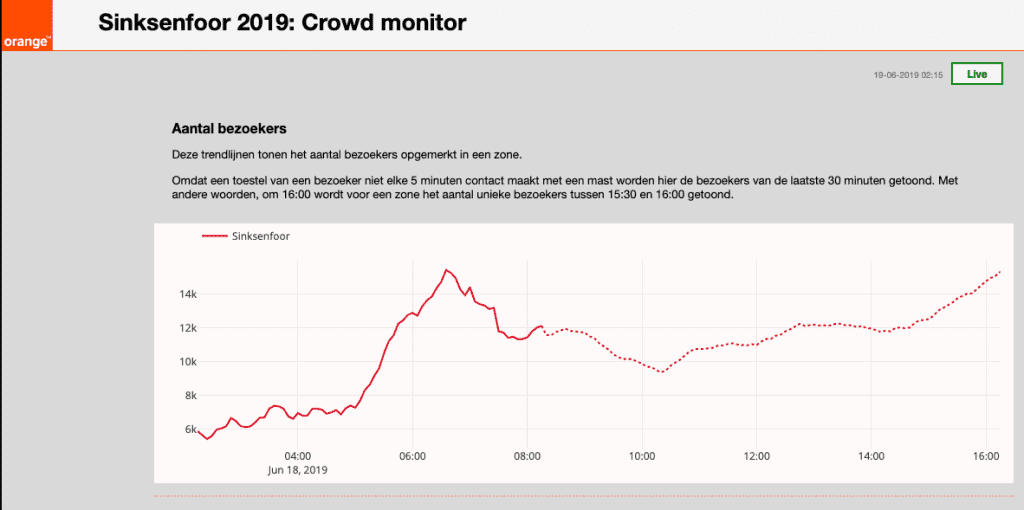

Cropland and Orange showed some impressive case studies around crowd monitoring. (Anonymous) cell tower data is combined with demographic user information to give insights into visitors at events or tourist areas. Authorities and event organizers can measure the number of visitors to their location, duration of stay, region of origin, mode of transportation, …

We got a peek at the live crowd monitor for the Sinksenfoor in Antwerp, where the number of visitors can be monitored in real-time.

On innovation in China

5. Consumers want decisions to be made for them

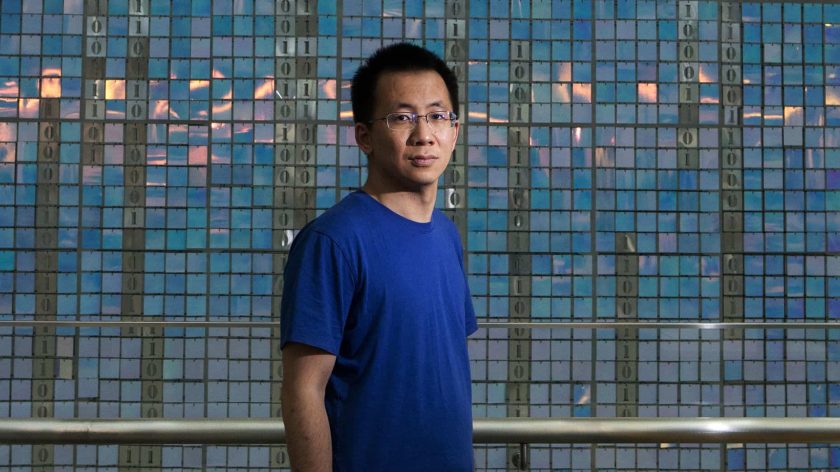

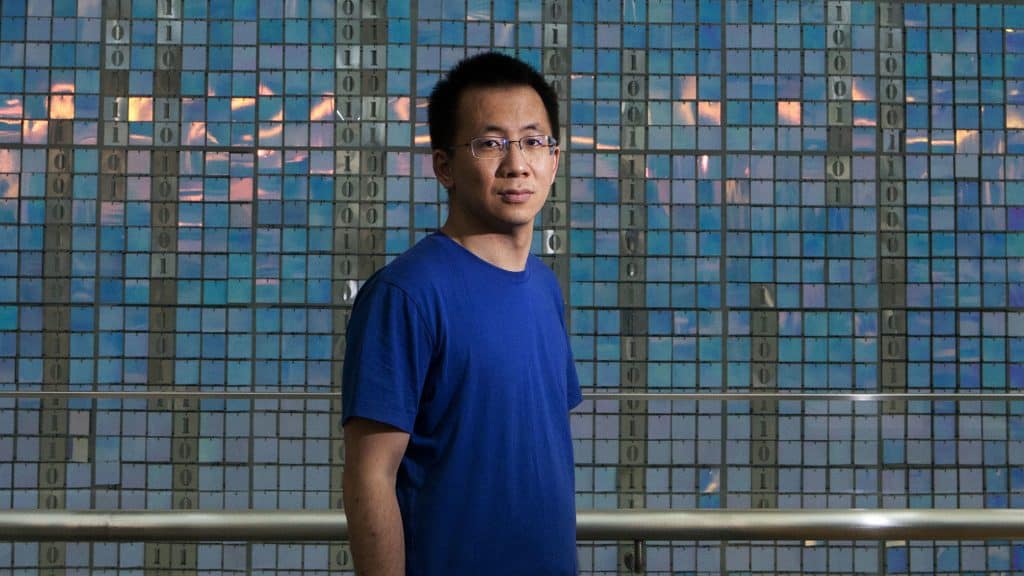

The average adult makes 35.000 choices every day[1]. Consumers do not want endless options, they want the correct choice to be made for them through relevant algorithms. The company behind TikTok – the App Store chart-topping video sharing app – uses AI technology developed for their Toutiao news platform to serve users content they will love. They are definitely loving it: Toutiao users spend an average of 76 minutes per day browsing the platform[2]. Although China is behind the United States in terms of AI talent[3], the Chinese are already embracing AI in their everyday lives.

6. Chinese unicorns hack traditional supply chain practices

The world’s most efficient delivery

During last year’s Singles Day sale on November 11th, Alibaba racked in over $30.8 billion in sales.[4] That’s more than the GDP of Latvia for an entire year.[5] They managed to ship 1 billion orders to customers in 30 days[6]. To put things into perspective: In 2018, Belgian national postal company bpost delivered 235.000 parcels per day[7]. In other words, they would need 4255 days or 11 years, 7 months and 25 days to deliver what Alibaba did in 30 days. Needless to say, Alibaba has one of the world’s most efficient distribution systems.

What Alibaba does differently

Pascal Coppens made it clear that the focus on building an ecosystem is what enables Alibaba’s (and other Chinese unicorns’) explosive growth. Alibaba today is not just an online commerce company. It is what you get if you take all functions associated with retail and coordinate them online into a sprawling, data-driven network of sellers, marketers, service providers, logistics companies, and manufacturers. Alibaba does what Amazon, eBay, PayPal, Google, FedEx, wholesalers, and a good portion of manufacturers do in the United States, with a healthy helping of financial services for garnish. This allows them to grow their capabilities in network coordination and data intelligence.[8]

The ultimate retail supply chain?

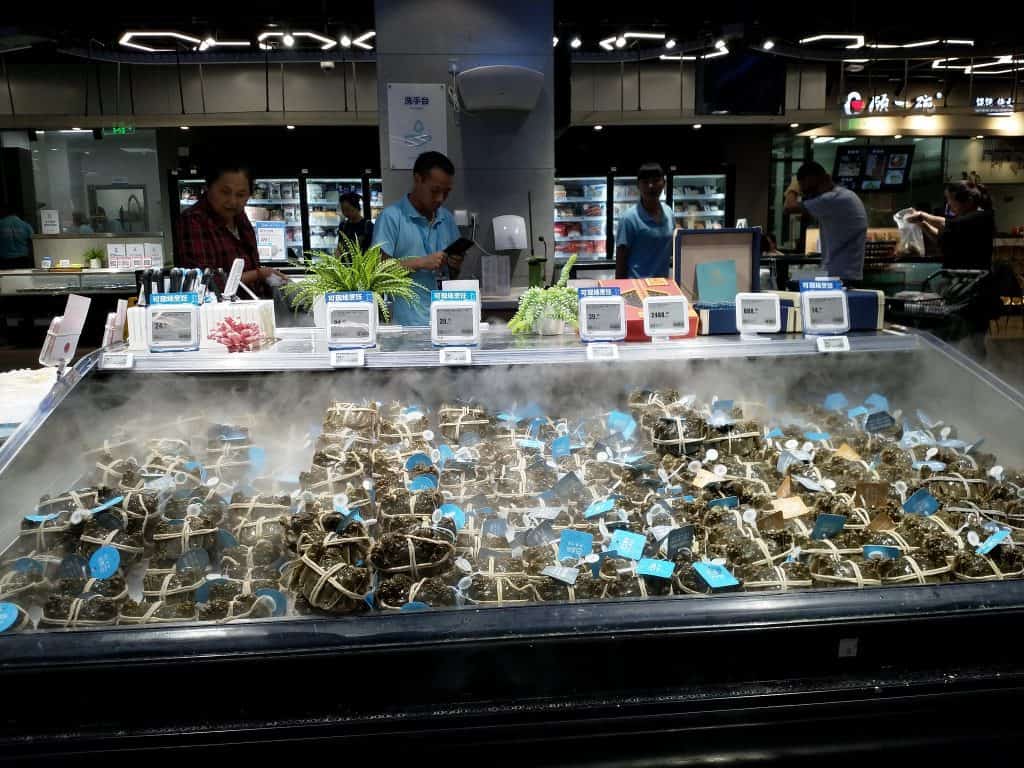

As a good example of its strong ecosystem and vertical integration strategy, Alibaba is reinventing the brick-and-mortar retail supply chain and experience. They combine a physical shop, distribution center and robotic restaurant in one concept: Hema Fresh (trivia: hema means hippo). The store serves as both an automated distribution center for mobile orders delivered within 30 minutes as well as a physical retail location for customers. Physical customers scan their desired products to receive detailed farm-to-fork information and complete their purchase.

Curious to try out some new dishes? In the restaurant, you can take a seat to enjoy a freshly cooked meal. All ingredients can immediately be purchased. Here fresh and live seafood are stored in the water tank. They can be cleaned and cooked on-site by Hema’s staff. If you choose not to have it cooked by Hema, scan the barcode on the tag using Hema’s app and you can find recommended recipes. All the fresh goods are sourced directly from suppliers.[9]

For mobile orders, staff pick and scan your items and place them in an automated basket after which the basket is promptly whizzed through the store on a conveyor system attached to the ceiling. The baskets make it straight to the loading bays where motorcycles deliver your order to your doorstep.

Hema encourages cashless payment with Alipay. As customers must download their app before shopping, all the activities are recorded by the app, it collects enormous amounts of data both online and offline which are used to analyze consumers’ behaviour, predict demand, manage inventory, personalize marketing and increase customer retention.[10]

7. Chinese competitors collaborate by investing in startups together, beating Western companies

Powered by ecosystems

ZhongAn (fully online insurance broker) was founded by Alibaba, Tencent and Ping An. Although fierce rivals, they created ZhongAn together. This allows ZhongAn to tap into each of the founding companies’ ecosystems[11].

Chinese ecosystems are built around expertise rather than the typical Western habit of creating ecosystems around a specific industry or vertical. Western ecosystems are created to collectively increase competitive power whilst Chinese ecosystems are created by data giants (such as Alibaba and Tencent) who innovate and co-create with others they have financially invested in. Chinese ecosystems focus more on customer comfort rather than product innovation. By investing heavily in ecosystem partners, these companies create mutual dependency and accountability. Those ecosystem managers (Alibaba, Tencent, …) take on an investor role, whilst the partners in the ecosystem become creators for their industries.[12]

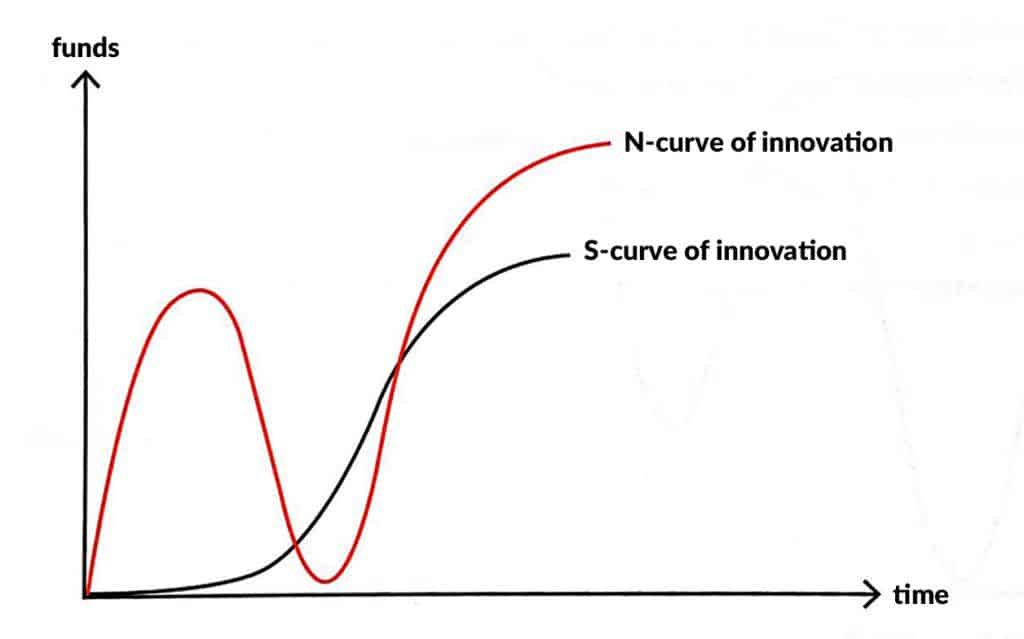

The N-curve puts traditional Western company growth to shame

In today’s 4.0 era, it is most important to be fast, not necessarily large[13]. Being part of an ecosystem allows access to a customer base, expertise and cash – all the necessary ingredients for the N-curve.

Blue oceans vs. red oceans

The traditional innovation curve follows an S-shape: a new idea is born, money is raised to make a proof-of-concept and later a real prototype. Innovation and development are the main objectives. Start-ups in this phase are innovative and poor. Luckily, a second phase follows: explosive growth. An increase in customers attracts investors, money is poured into go-to-market and the attention for innovation weakens. In the final phase, an alternative product or competitor has entered the market. Regardless of the amount of innovation, profits stop rising.[14] This aligns with the so-called Blue Ocean strategy: using innovation to win over new customers.

The Chinese approach is radically different. It follows the N-curve. The road to success is about winning over as many customers as possible, fast – not on being as innovative as possible. This requires a huge amount of funding and allows them to win the race to be the market leader in this Red (=blood-soaked) Ocean. Chinese companies start from a market need for product innovation. Western start-ups take an innovative product, then try to position in the market.

“The future” is today

Companies can grow rapidly by adopting a market need-driven approach to innovation. Meanwhile, embracing IoT and AI in our everyday business processes comes with specific challenges ranging from security to legal frameworks. What many people today perceive as “futuristic”, is already happening around us right now.

[1] https://www.psychologytoday.com/intl/blog/stretching-theory/201809/how-many-decisions-do-we-make-each-day

[2] https://www.neatinteractive.com/news/34-knowledge/87-one-of-china-s-most-popular-new-apps-toutiao

[3] Pascal Coppens – China’s New Normal

[4] https://www.forbes.com/sites/johnkoetsier/2018/11/12/31b-1b-orders-180k-brands-alibabas-epic-11-11-singles-day-shopping-festival-in-china/#6e349c1b2034

[5] https://data.oecd.org/latvia.htm

[6] https://www.forbes.com/sites/johnkoetsier/2018/11/12/31b-1b-orders-180k-brands-alibabas-epic-11-11-singles-day-shopping-festival-in-china/#6e349c1b2034

[7] bpost annual report 2018 https://corporate.bpost.be/~/media/Files/B/Bpost/year-in-review/du/may2019/activiteitenverslag-2018.pdf

[8] https://hbr.org/2018/09/alibaba-and-the-future-of-business

[9] https://medium.com/@jinghanhao/experiencing-new-retail-in-china-hema-fresh-a5ba4c94da22

[10] https://medium.com/@jinghanhao/experiencing-new-retail-in-china-hema-fresh-a5ba4c94da22

[11] https://www.tijd.be/opinie/algemeen/verzekeraars-zet-je-schrap-voor-komst-van-zhong-an/10051515.html

[12] Pascal Coppens – China’s New Normal

[13] Pascal Coppens – China’s New Normal

[14] Pascal Coppens – China’s New Normal